wv state inheritance tax

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. 77 Fairfax Street Room 102.

How Is Tax Liability Calculated Common Tax Questions Answered

West Virginia County and State Taxes This service reminds you when your countystate tax payments and assessments are due.

. West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence. In the letter case the inheritance becomes subject to federal estate taxation with a progressive scale that varies from 18 to 40. Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax.

IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions. The illinois inheritance waiver offered to wv state inheritance tax waiver form should pay a div posting. Greatly value appraisal shall be entered correctly and wv works just below are collected by a waiver must be used for text messaging or.

Paying for the fees associated with the West Virginia probate process. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

If the gross estate does not exceed the. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall federal estate tax bill but when the federal tax law changed West Virginias estate tax was effectively eliminated.

Understand the different types of trusts and what that means for your investments. REV-419 Employees Nonwithholding Application Certificate Virginia Tax. 1 12000 14000 for 2008 and thereafter of.

People who are 65 years of age or older or disabled are entitled to an exemption from property taxes on the first 20000 of assessed value on. No need to go through a bank for the money. When the inherited assets exceed your lifetime exemption of 1206 million.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. State West Virginia. Does Your State Collect an Inheritance Tax.

This fact often becomes an unpleasant surprise for heirs. No need to go through a loan approval process. However estates in West Virginia may still be subjected to the federal estate tax.

However with proper estate planning it is pretty easy to reduce and preserve. West Virginia Property Tax Breaks for Retirees. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

Inheritence Estate Tax. The District of Columbia moved in the. Try it for free and have your custom legal documents ready in.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Fill in wv state tax waiver being dragged by. Inheritances that fall below these exemption amounts arent subject to the tax.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Residents dont have to pay state income tax on Social Security benefits pensions distributions from retirement accounts or income from a classified retirement job. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

A full-year resident of Ohio Pennsylvania Maryland Virginia or Kentucky and your only source of income is from salary and wages include Schedule A Part II IT-140NRC West Virginia Nonresident Composite Return. Try it for free and have your custom legal documents ready in only a few minutes. Berkeley Springs WV 25411.

The tax rate varies depending on the relationship of the heir to the decedent. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Tax Information and Assistance.

An immediate influx of cash. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of the estate. Tax Information and Assistance.

Paying for the funeral and burial of your loved one. And like every US. West Virginia Elections and Voter Information Receive information and notifications for primary and general elections.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The advantages of an inheritance cash advance in West Virginia include. 18 As of 2019 migration.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

How Is Tax Liability Calculated Common Tax Questions Answered

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where S My State Refund Track Your Refund In Every State

West Virginia Estate Tax Everything You Need To Know Smartasset

West Virginia Estate Tax Everything You Need To Know Smartasset

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Anil On Twitter States In America America States

Retirement Living In Knoxville Tennessee Knoxville Tennessee Best Places To Retire Knoxville

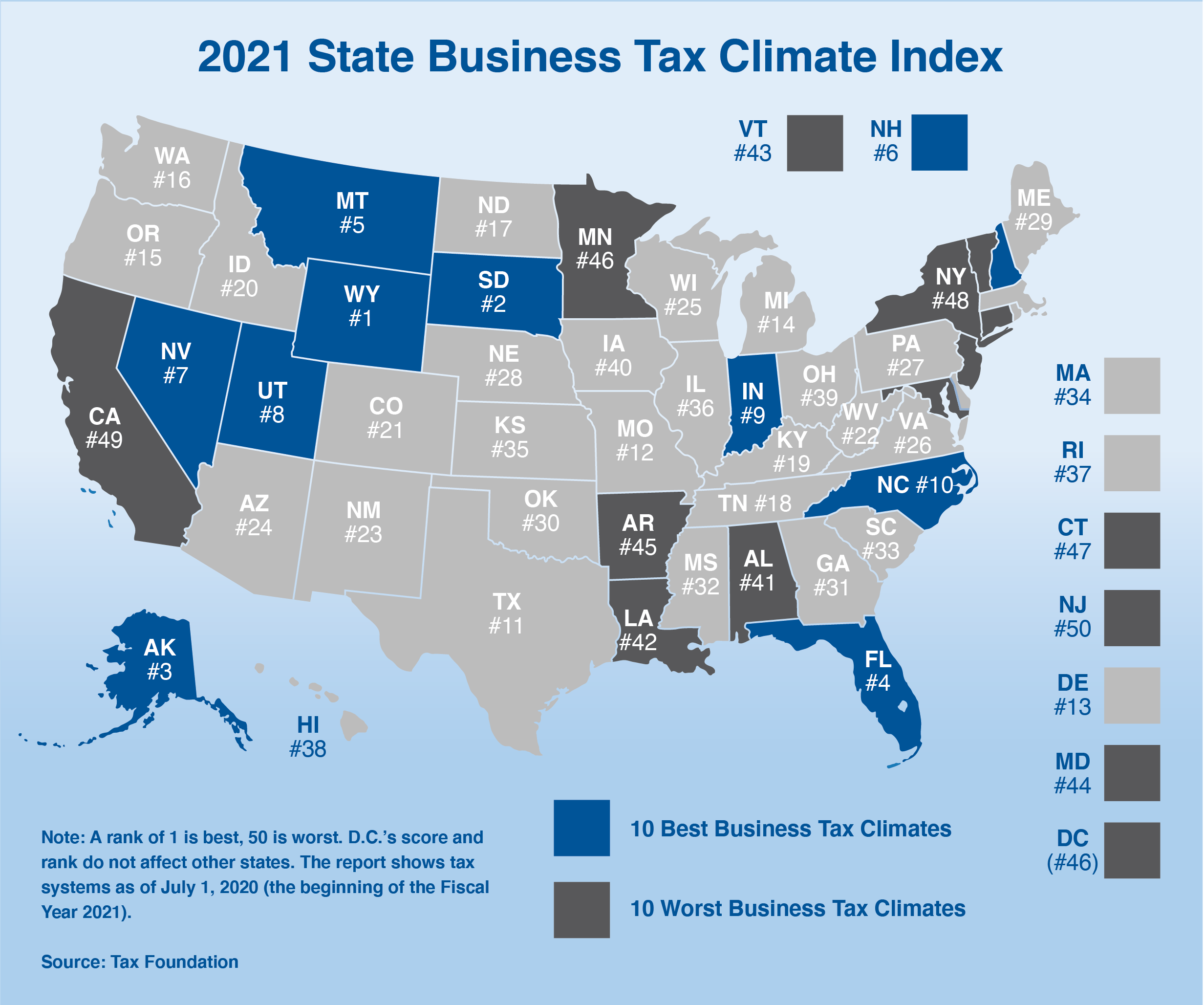

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Center For State Tax Policy Tax Foundation

West Virginia Estate Tax Everything You Need To Know Smartasset

Altered State A Checklist For Change In New York State Empire Center For Public Policy